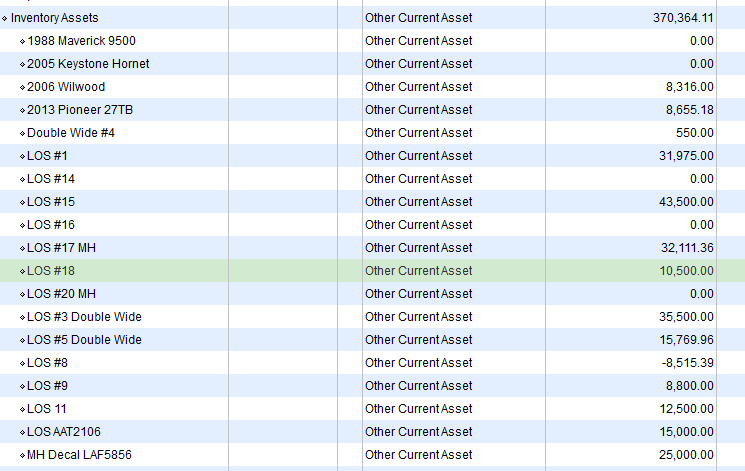

I am not a CPA, but in my experience, you should create a new Current Asset Account in your accounting software. In this LLC, I chose the name “Inventory Assets.” Then, I created a child account under the parent account of Inventory Assets with the description of each home. For example, “LOS #1” stands for “Live Oak Springs Space #1.”

As you acquire homes, I also suggest you add the date you acquired them either in the name of the Child Account or in the Notes in your Accounting Software. This is to help your tracking. Tracking is necessary because if you sell a home after 12 months and one day after the purchase, you get taxed as a capital gain instead of ordinary income.

“For tax purposes, the U.S. Internal Revenue Service’s general depreciation system guidelines give buildings or structures, including a mobile home, an estimated useful life of 27.5 years. So the mobile home is more considered a building/structure than personal property.”

The article later states that one could argue an MH can use a 5-year Depreciable life. If it were me, I’d go with the 5-year life, especially if I planned on selling them, i.e., fixing and flipping.

Source:

https://www.justanswer.com/landlord-tenant/jgpyy-depreciation-schedule-mobile-home.html#:~:text=For%20tax%20purposes%2C%20the%20U.S.,building/structure%20than%20personal%20property.

You should use straight-line depreciation with either a 5-year life or a 27.5-year life. To do so, you take your cost basis and divide it by the number of years you choose to depreciate the Unit.

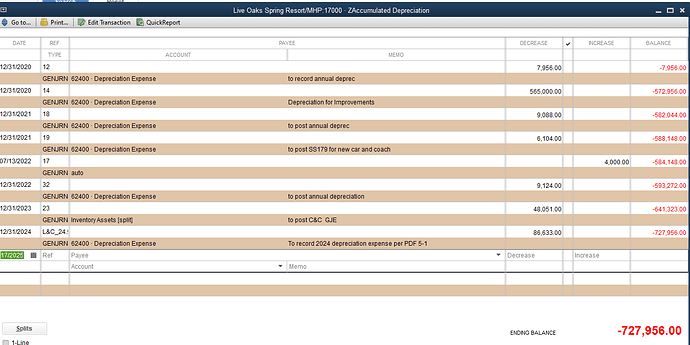

You must create another Fixed Asset account for “Accumulated Depreciation.” Each year, you must run the calculations for all your depreciable assets and make accounting entries to ensure you are crediting and debiting the correct accounts for the proper amounts. This is where you should rely on a CPA.

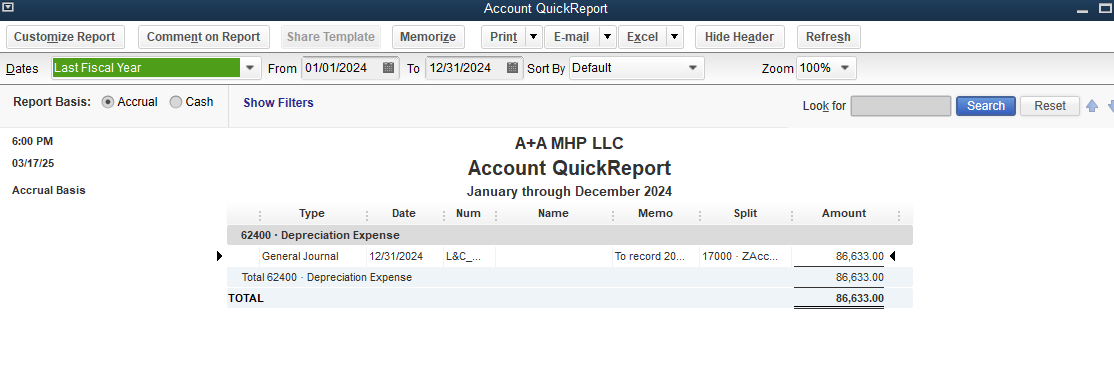

You must also create an expense account called Depreciation Expense.

Here is a screenshot of my Accumulated Depreciation Account.

Screenshot of Depreciation Expense:

While I am not a CPA, I can explain what and why. You depreciate the asset to get a Non-Cash expense/loss; You keep track of the Accumulated Depreciation because if you ever sell the property, then the Accumulated Depreciation you expensed gets added back to your ordinary income. Each Child account should have an entry for what you depreciated each year. That way if when you sell LOS #1 in year 2, you know exactly how much you will need to pay ordinary income tax vs how much capital Gains.

Simple Example.

12/01/2023 You buy an MH for $50,000

You choose a 5-year Depreciable life (we are going to ignore the Trump Tax Cuts for this example)

12/31/2023, you record $10,000 in depreciation expenses and add that amount to your Accumulated Depreciation account.

On 12/31/2024, you recorded another $10,000 in depreciation expense, the same as 2023

06/01/2025 You sell the Unit for $80,000

Now you must record a Capital Gain of $30,000 and a depreciation recapture of $20,000 in your books.

You will reduce your accumulated depreciation account by $20,000 and close the fixed asset account for the Unit to Zero.

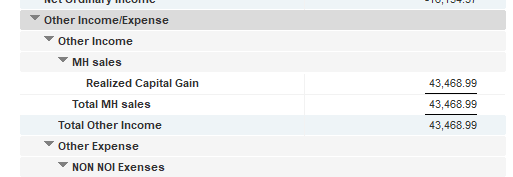

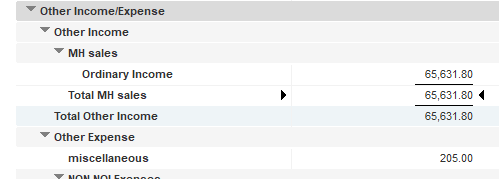

I have two extra income accounts: MH Sales Ordinary Income and MH Sales Realized Capital Gain. This makes my life more manageable for tracking purposes.

Last year, we sold a home within 1 year of buying it. Therefore, the profit is listed as Ordinary Income.

I hope this helps.