I have an LLC created to purchase MHP’s. I wanted to set up each park as a subsidiary underneath the parent company. Does anyone have any resources to learn more about how to do this? How do the financials work in a situation like this?

The resources are exactly the same as your other llc. Just make more of them. Has to have all the formalities with an operating agreement and everything.

As far as how the financials work, you have to track all the money in and all the money out. Generally speaking.

If one LLC owns 100% of another llc, the second LLC is ignored for tax purposes.

As far as how to “make sure” one LLC owns another llc, have the money from the one LLC be used to open the second llc’s Bank account. This is part of tracking all the money in and out. First LLC has to fund all the second LLC.

The Parent LLC should be set up as the “Holding” LLC. The Holding LLC will own all the Shares in the Subordinate LLCs.

Sub A LLC though Sub Z LLC will give Holding LLC a K-1 each year. The SUB LLC will not need to file a tax return as they are disregarded entities. However, your CPA will need to do the books to produce the K-1’s etc.

The financials work exactly the same as if you owned the Sub LLC’s directly, with the exception of not needing to file a tax return for each Sub LLC.

Since you and your Partner’s own the Holding LLC you will only get One K-1 from the Holding company. Instead of 1 through X LLC K-1’s.

This is a very personal question and the need to structure one way or another depends on your situation (e.g. you are the only owner, you have an investment fund, you have partners, you are syndicating). If you have one LLC own another LLC, the owned LLC is disregarded for tax purposes, and only the owning LLC pays taxes. However, if the parent LLC is owned by you personally or by partners, its taxes can be disregarded and the tax can be reported on the natural owner’s personal tax returns. I would discuss the benefits with a CPA and/or attorney.

We have a park in Ohio titled as a LLC and any court matter has to be handled by an attorney; otherwise, we would be guilty of practicing law without a license. Evictions are $500 a pop, something to consider.

There are two ways you can treat an LLC for tax purposes. One is as a partnership the other is as a Corporation.

If you select Partnership then the LLC’s income and expenses are included on your personal returns.

If you select Corporation then the LLC files its own tax return and produces a K-1 for each owner.

I always select Corporate because it insulates me during/from an audit.

My personal returns are WAY more likely to get audited than my business returns.

1 in 23 for my personal vs 1 in 358 for Each Entity. https://www.sfocpa.com/what-are-your-chances-of-an-irs-audit/

There is another neat option that you can use for an LLC. You can divvy up the percentage of income differently than the ownership percentage. This is very useful if you are married and your spouse makes money. And/or if you have a great job and make a bunch of money, but your wife stays home.

Here’s the play;

The Husband works at a W-2 Job making $200K/year. His wife stays at home.

You buy an MHP and your Year one Passive loss is $750K. You both own the LLC 50/50.

Your max write-off against your active income from a passive activity is $25k per year subject to income limitations and a phase-out. With a $250K income you get zero write-offs.

Well since you are married filing jointly, you can assign your wife 100% of the income from the LLC. Now your wife has a $750K passive loss. Well, that doesn’t help much right? Wait a minute. Your spouse works for the LLC at least 500 hours a year. Now that Passive loss is an Active loss. The $750K loss will pass through from your wife’s side to the Husband’s side and your adjusted Gross income will be negative and you will be able to carry it forward until you use it all up.

Disclaimer. I am not a CPA.

SDGuy, we appreciated this idea very much for tax write-offs. Here’s follow-up questions to your idea of divvying up the LLC income so the wife who stays at home is able to claim the bulk of the passive loss:

How would one go about setting up this scenario so it could be used within your household? Is this type of a structuring for maximum write-off done at the entity level when a person’s creating the LLC, or is it done later when the person is filing taxes?

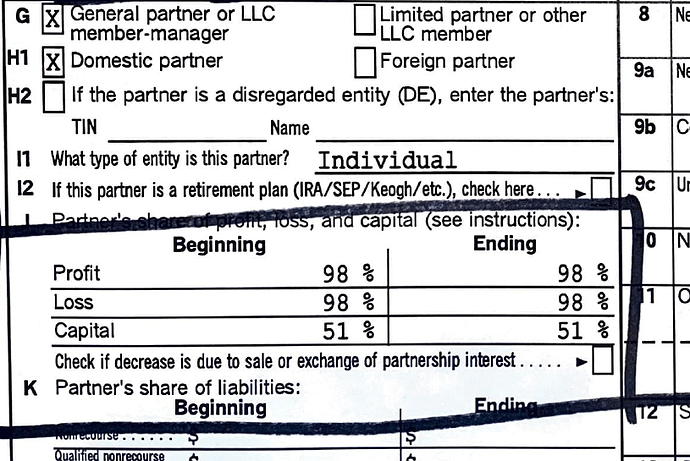

See the attached Screenshot from my K-1.

For this entity, I am a 51% Capital owner and my Wife is 49%.

However, for the Profit and Loss, I am 98% and she is 2%. I do not remember why we chose 98% and 2%.

This allows 98% of the profit/loss to go to my personal side of our Joint return. Since it is active income for me, it passes through to her side of the Joint return. Thus offsetting all my Active Income and the remaining amount offsets her active income.

DM me if you have any other questions.

To directly answer your question. This is done at the Entity Level. You can instruct your CPA to divvy up the Capital Account and Profit and Loss Percentages to best serve your needs.

AW