I have a park that I need to fill my remaining empty lots. I am looking at strategies to do that. I am just filing for my dealers license to buy new homes under the CASH program and bring them into the park to sell or rent in whatever form that takes or to use the rent credit program on possibly. That said… once I have the park finished … I plan to sell. Isn’t that kind of a problem since buyers do not want to have POHs? I need to fill the park to sell it for the best price and POHs are the fastest way to get there and have nicer homes in the park. Anyone have any input on that? Are there other strategies you’ve used?

Buyers prefer TOH over POH, however they also prefer a nice looking revenue generating POH over an empty lot.

As per your questions:

- “I have a park that I need to fill my remaining empty lots.”

- “I am looking at strategies to do that.”

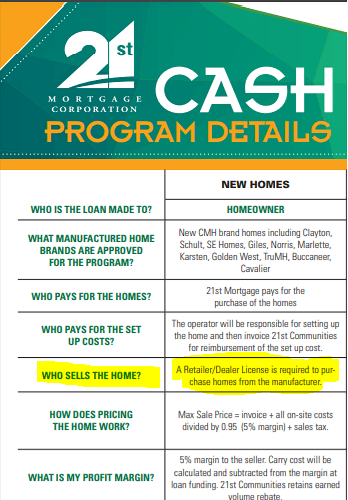

- “I am just filing for my dealers license to buy new homes under the CASH program…”

Four and a half years ago my Husband and I purchased a “Turn-Around Mobile Home Park”.

When we first purchased the Mobile Home Park we were under the impression that we will be responsible for bringing all future Mobile Homes into the Park.

We went to several Frank Seminars.

During these Seminars we learned about the “CASH Program” from various Speakers.

Over the years the “CASH Program” has changed/evolved. During this time frame we have considered participating in the “CASH Program”.

What made us not go forward with the “CASH Program” is that I am super Conservative with money.

The last time we looked at the “CASH Program” it made the Park Owner the ultimate holder of the debt.

Personally, I did not want to be left “holding the bag” of all the debt of the “CASH Program” IF the Mobile Home Owners were not able to continue paying their Mortgages.

I (and others) have asked on the Forum current “CASH Program” Owners who have listed their Parks “For Sale” what the results have been. I have not seen a response (but I could have missed it).

Personally, I would NOT purchase a Mobile Home Park with “CASH Program” Mobile Homes as I would NOT want to acquire that debt.

Over the years for our “Turn Around Mobile Home Park” we have purchased used Mobile Homes; brought them into our Park; renovated them and rented them. We have sold several of these POHs over the past 4 1/2 years.

Our preference would be to sell all the POHs. However, we have found that our Tenants (good Tenants) do not necessarily have the desire or ability to purchase the Homes. Thus, we continue renting to Good Tenants.

For the past two years we have been blessed with individuals who have purchased their own Mobile Homes and move them into our Park. We gladly pay both a “Referral Fee” (If Referred) and 2 Months Free Lot Rent. We do not pay for the Mobile Home Move, but we will help with the process of Moving (really NOT a simple or easy process ).

IF your plan is to sell after all spots are filled with “CASH Program” Homes, I would really encourage you to evaluate what Potential Buyers would get in the sale.

When selling your MHP might be at 100% Filled, but the “CASH Program” Debt might deter all Potential Buyers from your Park.

We wish you the very best!

Kristin, I am curious about the total dollar amount you spend in order to get tenants to move to your park. What is the lot rent (Since 2 free months) and how much is a referral fee usually? Thanks

@WarnerNAI , as per your Post:

- “the total dollar amount you spend in order to get tenants to move to your park.”

- “What is the lot rent (since 2 free months) and how much is a referral fee usually?”

Referral Fee:

- Referral Fee = $100

New Tenant Who Pays To Move Mobile Home To Our MHP:

- 2 Free Months Lot Rent = $550 - (Monthly Lot Rent = $275)

We wish you the very best!

I am of the opinion that a park with a few POHs will sell for a higher price than a park with a few empty lots. I could be mistaken, but my take on the CASH program is that these homes are technically TOHs, not POHs. My suggestion would be to check with 21st Mortgage to see what is required out of a park buyer in these situations.

In my case, I have defaulted to buying used homes and selling them (financing), to fill lots. If I were to sell, the buyer would have to be okay with carrying notes for those homes.

Just thinking-- with the RV parks the RV OWNER is bring in NEW and and nearly new RV’s–and some cost over $125,000-- and our RV sections are full. For mobile homes we need to bring in homes to fill our spaces WHY!!! We keep developing new spaces so we purchased new and use homes but seldom do people bring in new home?? Most nice RV cost as much as a mobile home but why the problem are park owner needing to bring in mobile homes to fill empty sites or replace antiques that are questionable. We keep seeing NEW RV parks being developed and most are full within 2 years—are consumer changing their buying habits–we are presently working on new RV sites and they fill immediately–just thinking!!!

I’m not looking to do all the work that an RV based business requires. Plus the 55+ parks have been seeing less activity the past few years and they give discounts I don’t need to give for a Mobile home based format or offer the amenities. I have RVs still in my park that families live in and they aren’t the new ones. They also can be moved a lot easier. That’s not the business model I am working on now. I am filling my park with as many mobile homes as possible.

I’ve always wondered what would be so ‘discouraging’ to a MHP buyer that had say, 125, 5 year old park owned homes.

As far as what someone mentioned in this thread about the buyer not wanting to assume the debt on the POH homes, how in the world would that happen? They buy the park and the homes, they get them debt free. It is the seller’s duty to take some of their sale price and pay off the debt on the homes.

As for 21st Mortgage and their CASH program, I haven’t had much luck. They’ve shipped me to 3-4 different ‘agents’ in 8 months. One got fired, one transferred, etc.

I know Frank and them recommend them but my experience has been they don’t do park ‘owners’ a whole lot of favors as far as financing a block of 25-50 trailers. They want you to be a dealer. We’re Not dealers, we’re MHP owners.

They’re geared up for individual trailer buyers.

In that particular scenario (125 POHs…) I’d buy at the right price.

I believe the comment about not wanting to assume the debt was in reference to the CASH program. In that situation there is no debt to assume. I think a more appropriate term is liability. If the owner of the home defaults, then 21st Mortgage will look to the new park owner to purchase the repossessed home for a percentage of the pay off at the time of repossession.

The CASH program is not only about new homes. Have you looked into their used home program? If you have POHs this can be a an attractive option. I do think it is a great program and there is no “dealership” agenda there. It is purely a financing alternative.

I’ll have to pin them down up there in Knoxville, but so far my reps (and I’ve had 3 already) have focused on financing only with manufacturers, or dealers (Me). I’ll follow up. Thanks. Will report back.

“CASH Lending Program”

21st Mortgage Corporations

As per “CASH Lending Program” Literature:

-

From:

9/12/2016 -

Who Sells The Home?:

A Retailer/Dealer License Is Required To Purchase Homes From Manufacturer -

What Are The Interest Rates?:

6.75% - 9.75 % -

What Are The Loan Terms:

23 Years = Loans Over $50K

15 Years = Loans $20K - $50K

10 Years = Loans Under $20 K -

What Is My Obligation To Purchase Repossessions?

Operator Agrees To Purchase Any Repossessed Homes For Payoff At Time Of Repossession

Since this information is from 2 years ago, I can only imagine that the details have changed.

However, I can also imagine that 21st Mortgage “CASH Lending Program” still requires that the Park Owners be ultimately responsible to purchase the Mobile Home for payoff at the time of repossession.

What happens if a Park Owner has to purchase a repossessed Mobile Home that is upside down (mortgage payoff more than the value of the Mobile Home due to a High Interest Rate and the Original Owners not taking care of maintenance issues)?

What happens if the Original Owners drop their insurance and then there is a fire that destroys the Mobile Home?

Yes, there are pros and cons in everything.

Thus, as a Mobile Home Park Owner you need to evaluate IF you are willing to accept both the pros and cons for a very extended time frame (between 10 years to 23 years).

However, as a Mobile Home Park Owner you also need to have an exit strategy (just in case) and you need to evaluate IF there will be a Buyer willing to accept both the pros and cons.

We wish you the very best!

Thanks @Kristin for the good advice.

I have been speaking to someone at the CASH program recently and I don’t think it’s a bad program to use to fill a park. I will be doing a combination of things to finish filling up the park. I personally do not have a problem with park owned homes but I am a hands-on owner. I like getting the house payment or rental AND the lot rents every month. That said, I also know I am going to want to cash out of this particular park to invest in more parks in the future so I will keep those numbers low to help it sell when it’s finished.

@Jsmith , thank you for your post.

-

What is the Mobile Home Park Owner’s responsibility for the Current “CASH Lending Program”?

-

Does the Mobile Home Park Owner still have the Obligation “to purchase any repossessed Homes for payoff at the time of repossession”?

-

IF Yes to the “obligation to purchased repossessed Homes for payoff at the time of repossession”, what do these numbers look like on a bare bones Singlewide 14 x 60?

Also, I would love to hear from Mobile Home Park Owners who had New “CASH Lending Program” Mobile Homes placed in their Mobile Home Park and decided to sell.

How was the process of selling?

Did the Buyers care that they were now ultimately responsible for the “CASH Lending Program” Mobile Homes?

What did the Bank / Mortgage Provider think of this responsibility of the “CASH Lending Program”?

Yes, 21st Mortgage still requires the new park owner to purchase the repossessed home for a percentage of the pay off at the time of repossession.

I wouldn’t mind carrying this “liability” if the price was right, the homes were in a reasonable condition, and the park was stable.

Every situation is different, but I am sure banks would still work with a buyer in this situation. Maybe they wouldnt know, maybe they would require a higher down payment, etc.

The used home program applied to POHs may be worth a closer look. 21st Mortgage will work with the park owner to finance the POHs to a home buyer. Their requirement for the park owner to purchase the repossessed home still remains. However, that liability exists now for most park owners selling POHs.

If you think about it, a clever investor could buy a park with several POHs at a discount, and then use the used home CASH program to recover his/her initial investment (and maybe more) by selling those POHs. In my mind, this opens a whole different world of opportunities for a clever investor willing to explore in areas others won’t.

The margin charged by 21st Mortgage is very high relative to the cheapest homes so you will not make any money buying cheap homes at a discount and turning around and selling them at a profit with 21st Mortgage carrying the paper. Maybe with new homes this would work.

I think this has been answered, but the problem is that it’s not 125 loans to the MHP owner. It’s 125 private-party loans that the MHP owner has agreed to guarantee.

When I said an investor could buy a park with several homes at a discount I wasn’t suggesting 21st homes. I was simply suggesting buying the park at a good price (considering it has POHs). Thus, if an investor buys a park that has a few POHs then that investor can recover some or maybe all of his initial investment by utilizing the used home CASH program.

21st Century is charging 7 1/2% interest on their loans as of today, so we can all do that math and make an informed decision.

According to the conversation I had with them on Friday, they will Not finance numerous trailers for an individual park owner/developer Unless the individual is a ‘dealer.’

I told my contact at 21st that I could buy trailers from a local retail dealer cheaper than I could buy them direct from a West Texas ‘Dealer.’ His employee checklist said, “No deal.”

Seems like becoming a ‘dealer,’ is everything from filling out a form and mailing in a couple hundred bucks, to giving away your first born, depending on what State you reside in.

21st Century is branding (cattle term) the small park owners. Why first of all does Buffett need an interest rate above 7% since 3% or less would be more in line with car sales. The repo homes being sold by 21st are very expensive forcing park owner to new homes. We work with a non-Clayton dealer to avoid all the paper work of being a dealer and find our pricing competitive. I suspect the big boys are getting a better deal from 21st than owner with 5 or less parks–plus their money is coming from their investors. As smaller operators put their parks in collateral instead of the potential homeowners is brilliant on 21st part freeing up their resources to control more than just dealerships. First time mobile home owners can easily WALK away but 21st knew park owner would be easier prey to recoup any losses. I still keep asking why the low number of tenants bring in new mobile home whereas we have a waiting less of RV’s with nice rigs wanting a spot?

I believe this is based on state law. In my discussions with 21st Mortgage we agreed I did not have to become a dealer since my state and circumstances did not require it.

Then buy the home from your local dealer. Once you have the home then apply the “Used Home “CASH” program.

Supply/demand and default rates comes to mind.

Rates do vary (6.75% up to 9.75% on new homes) depending on the home buyer’s credit worthiness.

Moving a home is a much more serious commitment. I also suspect mobile home owners and expensive RV owners fall under different demographics. There are those more affluent people that own an expensive RV and can pick up and go as they please. A family with kids is more likely to prefer a home.

As a park owner, I prefer to have the more permanent mobile home residents than RVers. I believe home owners will be more likely to

have stronger pride of ownership and would likely have more positive contributions to the park community and park stability.