I am cashing in. Selling the park. Offer accepted. Accountant says the sale will put me in the 20% capital gain bracket; that I should stretch some of the proceeds into the next calendar year to be in the 15% gains tax. I am retiring. Not looking to put the money at risk in one property hence thinking a 1031 fund or perhaps opportunity fund. Just place the money for about 12 months. Any recommendations or people to talk to.?

There are companies that specialize in 1031’s. I suggest you google the ones in your area and tell them what you’d like to do - they can offer great advice. Real Estate Attorneys may also be able to help.

I’ve used IPX 1031 a few times. They’re great - Whitney.Brennan at ipx1031.com

Was listening to Jefferson Lily’s podcast about this same topic.

Check out:

Starker Services Inc.

http://www.starker.com/investors.html

Recommend reaching out to Dave Foster at ERG. He has been assisting us with a mobile home park 1031 over the past few months and has been extremely helpful. Very knowledgeable and responds quickly to questions.

+1 Dave Foster. 20 chars.

The Opportunity Zone funds seem have some advantages over a 1031 in my situation. Low fees, no intermediary, no escrow, reduction of capital gain if held. Anyone have any recommendations for Opportunity Zone fund people?

There’s a lot of fly-by-night shops looking to capitalize on the strategy. The two most established CRE firms that have announced opportunity zone funds are CIM and Starwood Capital. Wealth advisors at places like JP Morgan are increasingly able to advise on which funds are available.

Dave Foster is the best!!!

My husband said to look into monetized installment sales if 1031 becomes too difficult.

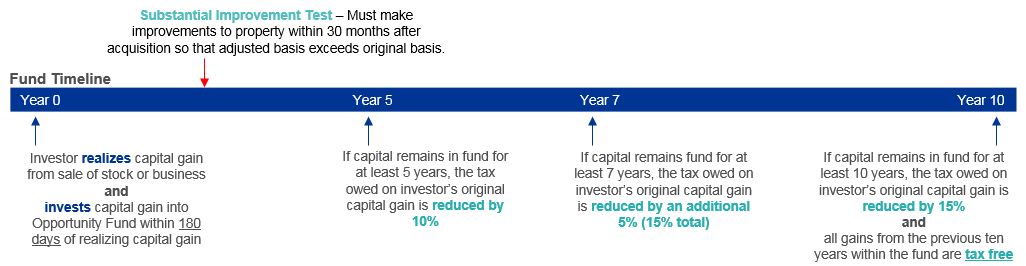

To get any benefit from an opportunity fund you would need to keep your capital gains from the sale invested in a qualified opportunity fund for a minimum of 5 years (see timeline below), much longer than the 12 months you noted above. There are also a number of grey areas that have yet to be clarified by the IRS and may not be for a while. The real benefit of investing in an opportunity zone comes after 10 years when you have hit all 3 steps outlined in year 5, 7 and 10.

To get a 10% capital gain reduction money has to stay in at least 5 years but I see nothing that says and investor must stay in that long. Say your original gain is $500,000. In five years the gain is reduced 10% by $50,000 to $450,000. Staying in for 5 years results in gains tax saving of 15% of $50,000 or $7500. Nice but not huge. Getting $500,000 at 15% gains instead of 20% is a $25,000 savings which is my objective. Take that money and and put it elsewhere for 5 years offsets the $7500 not received for staying 5 years or forgo the $7500 opportunity cost for liquidity.

Saratoga group just launched our second QOZ fund focused exclusively on mobile home parks. Like every other QOF out there, we require a 10 year commitment. That is because after 10 years all gains within the fund are tax free! Accredited investors can learn more at https://invest.saratogagroup.net/properties/mhp-fund-iv/

It takes some time, you will have to be patient and wait for it. Most likely it will take about 5 years in your case, but I am not totally sure. You can read more about this on Section 1031 Exchange, there are explained all the aspects and details which can occur. You should read and see what is better to do further, to reinvest the money or to keep them for yourself. The decisions are yours, think what will be better for yourself because only you decide what you do with your money.