How do you have your MHP setup? Is it great to have the MHP land and MH in 2 different LLCs?

Ideally, you have one LLC for the Property, One for the POHs, and One for the management firm.

If you are just starting out with one park, you can get away with one LLC for the Park, Management, and POHs, but as you grow, you want to set up additional protection.

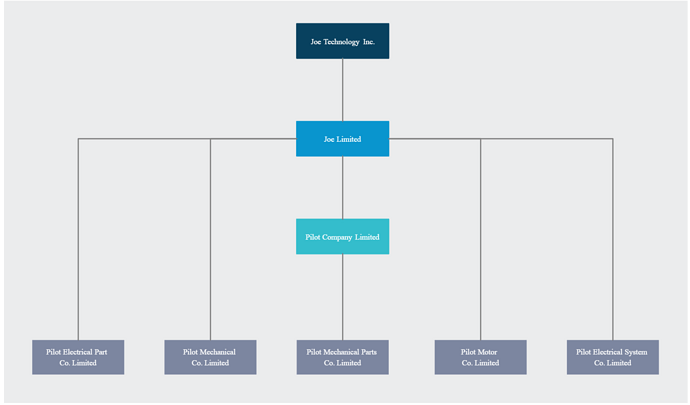

You can take it a step further and have an LLC as the Holding Company, which owns the LLCs that own the properties.

Setting up MHP (manufactured home park) and MH (manufactured home) in separate LLCs can offer liability protection.

Pros: Shield personal assets from MHP lawsuits.

Cons: Increased complexity and potentially higher fees.

Best consult a lawyer for your specific situation.

I agree with what was previously stated, however a complication of a separate LLC is that you cannot claim “inventory” status in some counties. Counties may allow you to consider vacant homes “inventory” and they will not charge taxes on those homes. To qualify as inventory, the home must be park owned and vacant. If it is a separate LLC, it is not park owned anymore and you will be charged taxes. Our home taxes can run from $8 per to $500 per year per home.