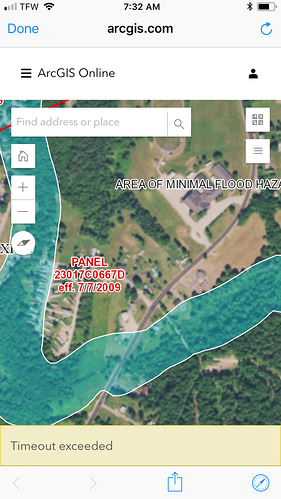

Have a reasonably good deal negotiated but just discovered almost half of park is in flood zone A. See attached fema map. How concerned should I be?

Its an issue, you need to have a good understanding of it. For starters has the park ever flooded, has the park ever flood historically, what was the impact? Can you replace homes based on current ordinances.

Whats base flood elevation. Right now, the property we are working on is in flood. Base flood elevation is about 1 -1.5 feet below the park. The mobile homes have to sit 12 inches above base flood so about 2-2.5 feet above base flood. Spot checking a few mobile homes, they sit that high anyway. So while technically the park is in a flood zone, for me, i was able to be comfortable with it. The homes are technically not in the flood zone ( but they still are) as they sit higher than base flood .

Also the fact that Houston just went through Harvey and this park had no issues ( and i saw how our other parked faired here , it got my comfort level to be ok.

Thats not to say its risk free but i tried to evaluate as much as possible and really understand what i perceived as the risk.

Some other factors might be who owns the home, you can obtain flood if you factor the cost on POH , perhaps mandate TOH carry flood.

While it would be great to have a perfect park in every way, you have to really analyze each deal for your comfort level.

If its a known flooder that washes away homes, i would certainly run for the hills . Try and do what you can to research and really have an understanding of this variable.

Appreciate those insights.

Fema maps are notoriously inacurate. You will most likely have to involve a surveyor to see where the park is in relation to the base flood elevation. If most or all of the park is out of the flood plain you can do what is called a “letter of map amendment” LOMA to officially modify the fema flood map. This will change the whole insurance issue. If the mark has lots of it in the 100 yr flood zone @Deleted_User_ME gave you good advice on how to proceed.

The replies here are great already, but find out when the most recent flood study was performed. If one has never been performed then FEMA will just estimate based on topography and other known factors to come up with the map. This is why @PhillipMerrill’s comment about them being inaccurate has so much credence.

To go through the LOMA process you will need to have a study of your own performed by a hydraulic engineer to confirm if the maps are bad, which unfortunately is a 5-10K proposition depending on your market and size of the study being performed.

I also forgot to mention on the NFHL maps you can also overlay where other LOMA’s have been submitted. If you see a high concentration this could be a good indicator if you might have some success.

One question; what does your lender think?

If your lender is OK, that helps with the go / no-go decision. After all, they have more at risk than you.

If you don’t plan on using a lender, get an experienced mh lender on board to help with your next step.

Keep us posted,

Mike Weiss

Seller financing, how would a my lender help in that instance?

I decided to move forward and will leverage the tips shared above during due diligence.