Recent buyer of a 26 unit park where I disposed of 14 trash homes. I currently have 19 open spots and am considering using the 21st mortgage CASH program to fill it. I would appreciate any positive or negative opinions. Thanks

I’ve heard from other park owners who have used this program recently that the home orders take a long time to fulfill due to production backorder, and that their underwriting standards for getting tenants approved to buy the homes can be very restrictive resulting in a lower volume of successful sales than you’d expect.

I hope what I’ve heard is wrong and that others have had recent success, as I’d like to make use of this program in the future.

I am fortunate that a home factory is 45 minutes from my park. I did a tour today and asked if I ordered today when would I get it. He said in the past they have been backed up as long as 6 months but he said he would have it complete in 14 days. The latest information I have says 21st has a 64 percent approval rate on accepting loans. Still undecided if I will do it but I will post how well it goes. My park is in Central Virginia.

I’ve used 21st Mortgage on a few homes.

Pros:

-They take care of compliance concerns, and service the loan

-The long term interest rate is high but not brutally so

-You can use them to buy a home with no money down

Cons:

-If buying a home with no money down, they charge a steep interest rate for this time between the home purchase and the home resale

-The sale process is a pretty big paperwork headache. Expect to spend a significant amount of time banging out paperwork. Once you’ve learned the program it becomes a little easier.

-They aren’t very transparent on the financing charges to the dealer. I asked for a payoff quote on a home that was in our inventory, and they give no breakdown of how they’re calculating their quote.

-You’re guaranteeing the majority a loan that is amortized over 20 years, secured against a depreciating asset, and has a likely subprime borrower.

If your park is in a really good market it’s probably worth it, if you’re in a more mediocre market the program will likely be more trouble than it’s worth. One thing to consider too is if you can wing it, buy the home yourself, and then sell the home through 21st rather than using 21st to finance the purchase from the factory. The financing charges will be a lot lower this way.

Thanks for the info. If I purchase and then sell to someone having them finance through 21st am I still on the hook to buy the home if they default?

Thanks @Noel_S, helpful answer. Can you clarify on your first con, are you saying they charge interest during the holding period? Is this even for new homes through CASH? Is this paid out monthly or accumulated?

Keith, if you use the CASH program to order the home directly from the factory with no money down, 21st is going to charge a steep interest rate for that service, with that interest charge getting repackaged as a markup to the final sale price when the home is sold.

TWood - yes pretty much, the retailer has to guarantee the loan. The level of guaranty is theoretically reduced for credit worthy end buyers with higher credit scores, but the program is poorly implemented, with no clear disclosure at the end of each loan of how much of the loan the retailer is guaranteeing.

@TWood, as per your post:

- “21st Mortgage CASH program, use or not use?”

First of all, Congratulations on your new Mobile Home Park!

My Husband and I own 2 Mobile Home Parks:

- MHP #1: Stable MHP

- MHP #2: Turn-Around MHP (in 5.5 years has gone from 27 Filled Lots to 62 Filled Lots)

Personally, we have not used the CASH Program. We have heard a lot about it and have considered using it. However, thus far we have not used the CASH Program.

There is a January 2019 CASH Presentation on www.mobilehomeuniversity.com :

https://www.mobilehomeuniversity.com/emails-and-events/clayton-21st/cash-launch-interview/recording.php

The CASH Program has been around since 2012 and has had multiple revisions in the details.

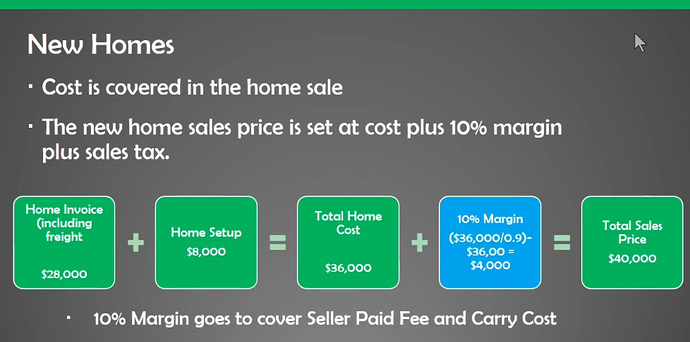

As per one of the CASH Slides (screen shot below):

- “New Homes”

- “Cost is covered in the home sale”

- “Home Invoice (including freight) + Home Setup = Total Home Cost + 10% Margin = Total Sales Price”

My concern with the CASH Program is:

- What liability/responsibility is the Mobile Home Park Owner signing up for IF the New Home is repossessed?

As per another of the CASH Slides (screen shot below):

- Repo Homes: “Operator purchases repossessed home for payoff (tiered 60% to 95%)…”

When the Home is repossessed and the “Loan” includes all these Fees (Freight & Setup & Margin), will the “Payoff” be more than the value of the Home?

What IF the Mobile Home Park needs to be sold BEFORE the Homes are sold or paid off? Will other potential MHP Buyers desire to take over the Liability/Responsibility of the CASH Loans?

We wish you the very best!

The buy back is what I am most concerned with. I would love to know what method you used to fill the park. I have a dealers license in Virginia so I can purchase factory direct. I have considered paying cash and having the home move to the park but not getting the title in my name. Sell as a new home with them getting their own financing. Any suggestions would be appreciated. Thanks

@TWood , as per your post:

- “…I would love to know what method you used to fill the park…”

We have filled our Turn-Around MHP in the following ways:

- Purchase Used Mobile Homes - From Individuals: From Individuals on their land - 2 Individuals had just completed their dream, stick built house, so they were just using the Mobile Home while building.

- Purchase Used Mobile Homes - From Mortgage Company: We purchased a 21st Mortgage Repo from a local MHP where the other MHP Owner had requested that we bid/purchase - The other MHP Owner had a “Waitlist” for New Homes to move in.

- Purchase Used Mobile Homes - From Mobile Home Mover: We purchased a couple Mobile Homes from a Mobile Home Mover who just wanted to flip for extra money

- Give New Tenants 2 Months Free Rent: If an Approved New Tenant wanted to move their Mobile Home into our MHP, we would give them 2 Months Free Rent after they moved the Home in

After we moved the Used Mobile Homes into the MHP we would have new underskirting and stairs installed. In addition we would have renovations done inside.

We wish you the very best!

Thanks for the info. I am working on your option 4 as my primary plan. I am working with local sales departments and offering 3 months free. I have had many tell me that it will not work. What kind of success did you have? Thanks

@TWood , as per your post:

- “I am working on your option 4 as my primary plan.”

- “What kind of success did you have?”

Option 4: Give New Tenants x Months Free Rent

The majority of the New Old Homes moved into the Mobile Home Park came in based on Option 4:

- Give New Tenants 2 Months Free Rent for moving their Mobile Home into our Mobile Home Park

The only reason we purchased Homes and brought them into the Mobile Home Park is because we “thought” that was the only viable avenue.

After we turned the Mobile Home Park around a bit we started to get calls from Individuals that wanted to move their Mobile Homes into our MHP.

The ability to have Individuals move their Mobile Homes into your MHP depends upon:

- MHP Location

- Job Supply In The Area

- Supply & Demand Of Other Mobile Home Parks

- Your MHP Rent Compared To Other MHPs

We wish you the very best!