Hello Fellow MP investors.

I am evaluating a park and right now at the very first step of looking at the seller provided price and numbers.

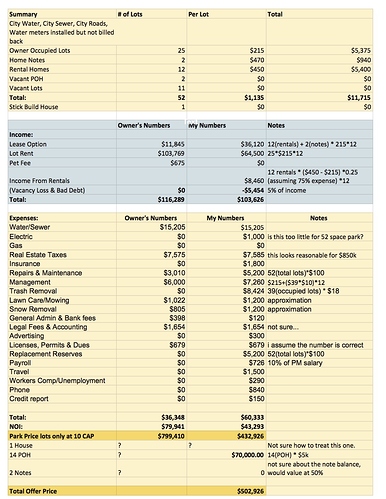

Asking price is 850K, stated income is $116k

Using Frank’s formula i am at $116K0.610 = $696k (if i take seller’s income and don’t include POH homes)

I am attaching a screenshot of my minimalistic spreadsheet (you can click to maximize, i figured it’s easier to visualize like that) where i try to evaluate what was reported by seller and my (newbie) assumptions. This is without going into market research, just plain numbers.

Please let me know what you think. If i am missing some line items or if some are too high/low.

I hope that this would help others in evaluating their deals.

Your note on real estate taxes says “this seems reasonable”. Quick math has an implied mileage rate of less than 1% at an 850k price. In many places, taxes can exceed 2%.

Real estate taxes are one of the easier expenses to forecast because all tax bills are public record and a simple call to an assessor will give you insight into how they reassess. I would recommend digging into that a bit more, especially if this seller is the original developer or has owned it for quite some time, their basis could be quite low.

@newwisconsinbuyer, good point. It’s most likely will be at least 50% higher.

I have not verified with the city.

I am approaching this exercise as a high level case study. Something that one would take after applying Frank’s formula.

So based on reported income and expenses Frank’s formula makes it a “maybe”. But after an 1 hr. number crunching - this already looks way overpriced.

So i wanted to share to get opinions.

Thank you!

Well there’s something else you should keep in mind too when you’re evaluating parks.

Not all parks are 10% cap rate deals. There are plenty out there that should, and are trading for lower than that. Stabilized parks in the Midwest trade for lower than a 10% cap rate, and often you’ll see parks come in lower than that too due to mismanagement (e.g. higher expense ratio than it should be). Anyway, just something to keep in mind.

I am also realizing that i am making the BIG mistake that everyone warns against on here.

Never-ever capitalize income from park-owned homes!

From my spreadsheet i have $8,460 of income (even though discounted at 75% expense ratio) for POH. As a result i CAP that income at 10% and end up paying $84,600 for 12 park owned home.

Then, down below i add another 70k for those same 12 homes.

So , realistically the price should be $384,330 + $70,000 (for homes) = $454,330 plus whatever the stick built house is worth.

Which is like 1/2 of the asking price…

Interesting review. I am no expert but your numbers seem a little light on insurance ie. park and POH rentals. Also what is up with the garbage? Owner has zero and you load up 8k? I always get apprehensive when sellers appear to not fully disclose. Sometimes you have to have that tough conversation with the seller to get them to see the honest reality as you walk away. I have had a couple call me back a few months later once they ‘come to Jesus’ and realize there situation.

Owner had a lot of $0’s. No insurance, no electric, no payroll, no travel, no phone, no workman’s comp…

I also think that insurance is low.

I think i found an ~$18/per lot estimate on the garbage on here, and applied as an estimate.

I have yet to verify this with the owner (as i am having a really hard time getting anything from the broker) but as far as i know park does not bill back for garbage.

Maybe someone could chime in if $18/lot is too high?