Hi,

I’ve been lurking around the board for several months and will be attending boot camp in April. I came across the following deal recently and I would appreciate any feedback/critique of my analysis. Thanks in advance!

2 Parks sold as package deal with additional 3 stick built rentals and a 30X30 metal shop building.

Location:

Pop: ~200K

Unemployment: 3.7%

Median Home: $130K

Parks:

1, 35 lot (3.65 acres) and 1, 25 lot (4 acres) – collectively, 60 lots

42 Occupied, all TOH

Avg. $189/month lot rent + utilities

Water sub-metered at both parks and owner reimbursed for water usage by tenants

3 Stick Build rentals:

1 rented @ $485/month +utilities

Price/Financing:

$725K, owner will finance with $150K down

Rough Evaluation:

4218960= ~$476K

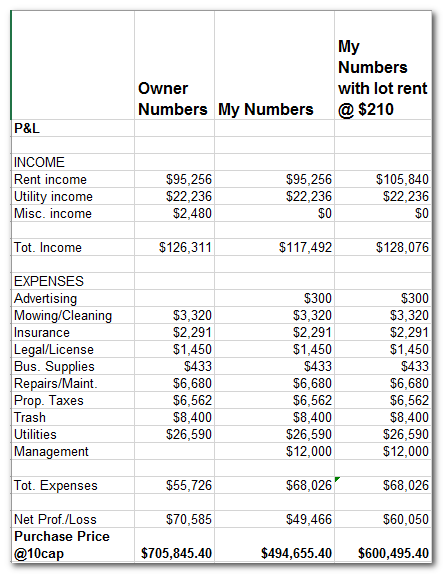

The owner sent his P&L for both parks which I combined and adjusted with my own numbers (see below). I erred on the high side for management cost and removed the line items for misc. income. The numbers below are for the park only and do not include the stick built homes or the shop. How should I go about accounting for the stick built homes and the shop? The owner said the negative difference in the utilities is due to: (1) him keeping power on at several vacant lots, (2) keeping the power on at the shop building, (3) keeping the power on at vacant stick builts, and (4) billing his cell as a utility against the park.

Are there any substantial costs I am missing or additional considerations?