Yes, I think it is “black and white” i.e. there is no wiggle room. That doesn’t mean you’ll get caught but the correct answer is 27.5 years for dwellings, regardless of whether they are “affixed” or whether they are personal versus real property. I am not familiar with the rules for hotels/short term rentals which may be different.

We disagree. It’s fine. I’m not in the business of policing the definition of a “dwelling” according to the IRS, which is why I think it’s grey. I don’t think that that is incumbent upon me legally. I have no idea what my tenants do or where they choose to spend their time. If they pay their rent and don’t cause problems, I’m all set.

My own personal dwelling, and how I file taxes as a result, is black and white.

I’m not an accountant as I said but I’ve spoken to many and there is no consensus on this.

If I owned/operated/lived in CA would I feel the need to track actual tenant days lived in a trailer? Perhaps.

I think the intent of IRS publication 527 is pretty clear, so much so that they specifically mention mobile homes as residential rental property, which gets a 27.5-year depreciable life.

“Residential rental property. This class includes any real property that is a rental building or structure (including a mobile home) for which 80% or more of the gross rental income for the tax year is from dwelling units. […]”

Unless it’s clear that the homes in your park aren’t used as homes, I think you’ll face long odds in making a winning argument to the IRS that a “dwelling unit” isn’t sufficiently well defined or that what quacks like a home isn’t a dwelling unit, should it come to that.

Use cost segregation for home components, if the cost/benefit is worth it. Otherwise use 27.5 years.

Really great stuff here.

Wonder if anyone has been through an audit with a 5 year home classification and it’s passed…

I have a cost seg firm (that has been around for 20 years and done over 10k studies, they have done 50-60 MHPs thus far) which is willing to classify them as “readily movable mobile homes” on the depreciation schedule, as long as I put axles and wheels on em. They will also defend their studies in case of audit.

Is this something you can get comfortable with from a risk perspective? After all we are relying on their professional cost seg study.

Also wondering your opinion on utility lines schedule (water, sewer and electrical) and wether or not they follow the treatment of the homes i.e. 5 or 27 year ?

How about the concrete home pads ?

Also wondering if anyone has included a line item for goodwill and If so how you depreciate that?

I really appreciate all your feedback !!

Any goodwill created in an acquisition structured as an asset sale is tax deductible and amortizable over 15 years along with other intangible assets that fall under IRC section 197

@Brandon

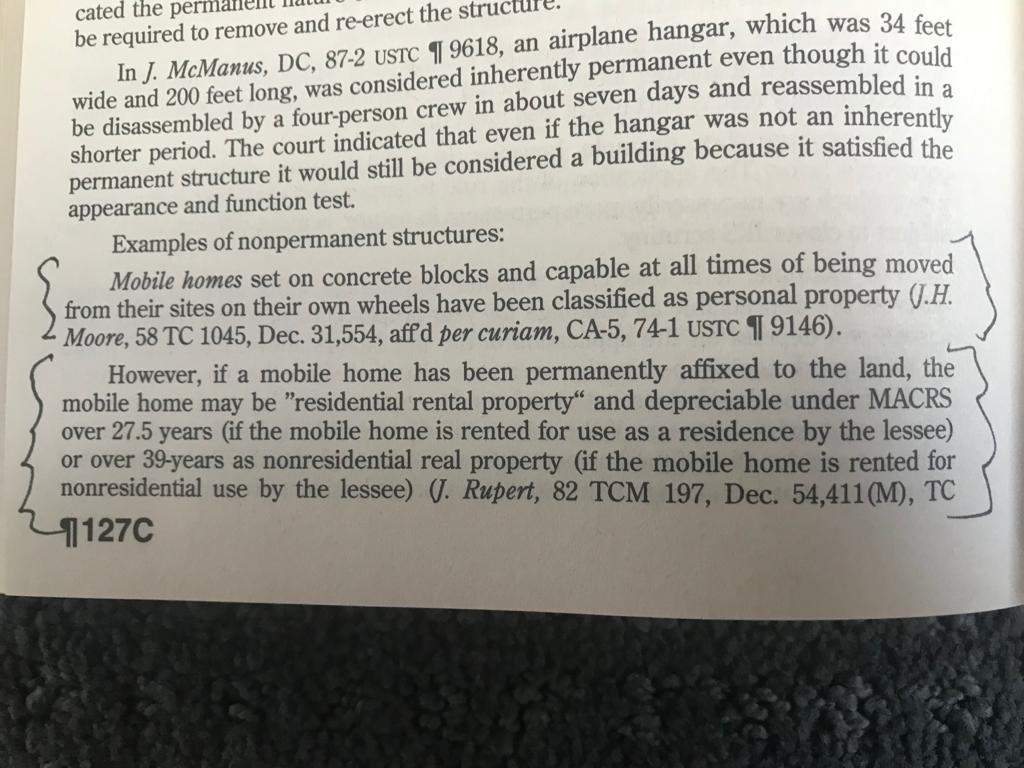

this image is taken from the Master Depreciation Guide published by the IRS. Seems to say that even if the mobile homes are on blocks, as long as they “are capable of being moved at all times from their site on their own wheels” they are classified as personal property.

Would that not clearly mean that if you leave the axels and wheels on they are clearly 5 year property?

Property that is not affixed to the land is personal property, almost by definition.

Just because it’s personal property (indeed it is) doesn’t mean it is five year property.

@Jackary @Brandon @mhp - Based on the above posted article quoting Revenue Ruling 77-291 would you feel comfortable classifying mobile homes as 5 year property ?

And have you seen anyone else classifying them this way.

I understand the 27.5 Year route is safer, However i’m wondering if there is any basis to go the more aggressive 5 year route, so long as you leave the axles attached and there’s no built up foundation- this should be classified as readily movable? Anyone doing it that way?

Also wondering if anyone on here has undergone an audit successfully with a 5 Year classification on the Mobile Homes ?

There is no basis for using Revenue Ruling 77-291 since that is from 1977 and the law has changed. That RR has no legal precedence. There is no grey area here. All of the above comments about 5 years have been rebutted. Homes are 27.5 year property, it is absolutely clear.

Jefferson, what is the name of cost seg company?

Thx - Tim